Apply Business Loan Online up to Rs. 50 Lakhs

Find the best quotes for collateral free business loan online from multiple lenders with flexible repayment options.

Easy

Documentation

Low

Interest rates

Quick

Processing

Flexible

Tenures

What is a Business Loan?

Business loans are the type of loans designed to cater to the needs of small businesses or enterprises. It can be helpful to meet your capital requirements and for expansion purposes.

Several banks and financial institutions offer customized business loans at attractive interest rates to people involved in the business. Usually, people applying for business loans need not provide any collateral or security.

While personal loans can help you take care of your personal needs, funding a business is a bigger commitment, business loans are the perfect answer for it.Advantages of Personal Loans

Personal Loans are unsecured loans with a tenure of 12 to 60 Months. For shorter tenures, the EMIs are higher, while for a longer tenure, the EMIs are lower.

The interest rates for business loans begin at 13.5%

Minimum Loan Amount Rs. 50000

Maximum Loan Amount Rs. 50 crores, can extend depending on the nature of business

Repayment Period - 12 months to 5 years

Collateral not required usually for unsecured loans.

Minimal Paperwork - Online business loans require minimum documentation.

Things to Know before applying for a Business Loan

Borrow what you need

Generally, the quantum of the loan amount in a business loan is high. However, it does not mean you need not assess your requirements to know how much exactly you need. It is best advised not to borrow more than what you can afford. Repayment during such instances may be a big problem.

Understand the business loan types

Most banks and NBFCs offer multiple types of loans as a part of their offerings. Not every loan will suit everyone. Some loans are aimed at a specific section of society with benefits such as lower interest rates. Hence, understand the different types of loans and choose the one which fits your requirement.

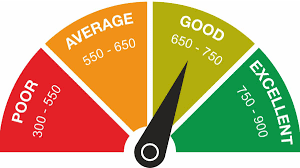

Credit Score

While banks do check your credit score as a part of their verification process, it’s better to have an idea about it yourself. Usually, the lenders sanction business loans to people with a credit score of more than 750. Before applying for business loans, ensure your credit score is 750. If not, take steps to improve your credit score.

Types of Business Loans

Professional Loan

Professional Loan is given away to self-employed professionals like Doctor, Advocates, and Chartered Accountants. These loans are processed based on the professional’s credit history. In many instances, the loans are provided against collateral like Non-agricultural land, fixed deposits, bonds, and policies. The loans are usually long term in nature.

Eligibility to avail Business loan

Business loans can be availed by self-employed, manufacturing and services companies, and private limited companies. Each lender has a specific set of eligibility criteria that the applicant must fulfil for successful sanctioning. Some standard eligibility criteria for business loans are:

- Age limit – (21 to 65) years old

- The applicant must have not any criminal background

- Applicant should have a good credit score and must not have defaulted on previous loans

- Income Tax Returns for the past three years

- Charges and Fees, turnovers, operational history differs from lender to lender.

Documents Required to get a Business Loan

- ID Proof – PAN Card, Aadhar Card, Voter ID, and Passport

- Address Proof – Ration Card, Aadhar Card, Voter ID

- Recent Passport Size Photographs

- Business address proof

- Bank Account statement for the past six months

- IT returns for the past three years

- Proof of ownership of the possessions used to carry out business activities

- Balance sheet, profit and loss accounts

- GST, Registration certificate

- Sales tax certificate

Eligible Entities

- Self Employed professionals like Doctors, CAs, Architects

- Sole Proprietors

- Partnership firms

- MSMEs

- Companies involved in Manufacturing and services company

- Private limited companies

- Artisans and Retailers

Why apply for a Business Loan?

Are you fed up with numerous visits and phone calls with false commitments? No problem! At Apnee Bank, we have created a loan aggregator system that will help you find the perfect loan.

The documentation process and approval of loans are done simply with minimal paperwork.

How to apply for Business Loan?

- Login to Apnee Bank and fill in details like your mobile number, loan amount required, city or residence, annual turnover and profits.

- Submit the form. You will get offers from different banks and NBFCs based on your eligibility.

- Compare and select the offer which suits you the most and apply for it.

- Once you provide all the documents required to process the loan, the bank will verify your eligibility and decide whether to approve or reject your business loan.

Blogs

The big design: Wall likes pictures

-

Posted by

- 0 comments

New home decor from John Doerson

-

Posted by

- 0 comments

Minimalist Japanese-inspired furniture

-

Posted by

- 0 comments

Creative water features and exterior

-

Posted by

- 0 comments